For countless years, one of the more traditional aims for nuclear families and first-time home searchers alike has been to own their own property. Although purchasing is still the more popular way to go when moving home, a startling number of people in the U.K. are shunning this traditional route and opting instead for renting a property – and this number is only expected to rise.

The number of rented households in the U.K increased by 63% from 2007 to 2017[i], and this number has held fast during the pandemic. Based on the rising statistics, it’s predicted that the U.K is likely to become a nation where renters make up the majority of dwellers – and we’re here to explore why. From the reasons why more people are opting to rent to whether buying or renting a property is best, we’ve looked into why the U.K is set to become a nation of renters.

Renters Are On The Rise

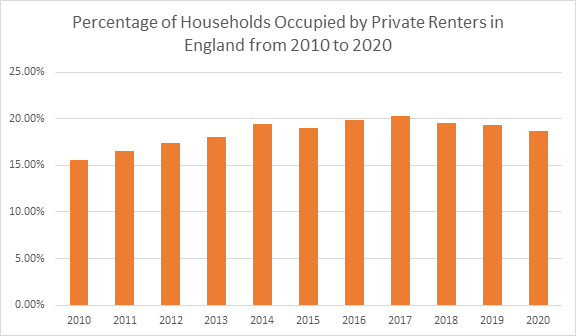

Although homeowners still outweigh renters, the difference is constantly slimming down. Around 4.4 million households were privately rented in 2020[ii], and it’s been predicted that, by 2025, 60% of the U.K will rent[iii], meaning more people are expected to rent a home in four years than own one. As you can see below, the percentage of households occupied by private renters in England has mostly had a steady rise over the past 10 years.

But Why Are More People Renting?

This increase in renters around the country begs the question: Why are more people renting? Many benefits come with not owning a property, and more people are embracing them as they step onto the property ladder. Let’s look at some of the things that influence the decision to rent and why these may be better than you’d previously thought.

Flexibility

Renting a property gives the lessee a certain degree of flexibility because they are not tied down to their home, and as more people crave a more freeing, minimalistic way of life, they search for this pliancy. Some people temporarily rent while they look for a more permanent home to purchase; some are constantly on the move with work and their personal lives, but whatever the reason, renting provides people with the flexible opportunity to move in and out when they so require.

Efficiency

People are increasingly looking for more convenient housing, and rented properties are more likely to provide this efficiency. Apartment buildings and communities where renting is gaining popularity offer fitness centres, community rooms and other valuable assets a short distance away from home, meaning people don’t need to travel far or spend a lot of money.

Rising House Prices

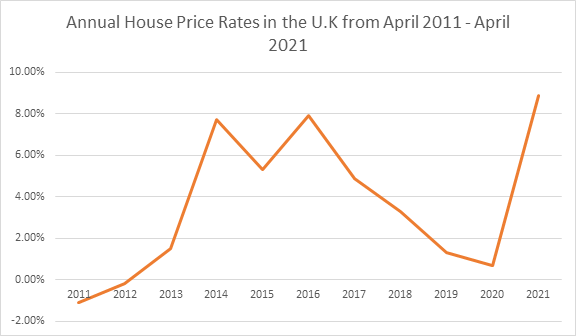

In March 2021, property values were shown to have risen by 10.2% since the previous year, which is the fastest growth rate in 14 years.[iv] More people looking for a house with certain specifications and the lack of suitable homes on the market is driving up the prices because the sellers are losing money the longer their properties remain vacant. Perhaps unsurprisingly, houses with room for families of four or more have risen the most, and those families cannot afford to buy a home big enough.

Avoiding Mortgage Plans

Mortgage plans are some of the most expensive fees, and many millennials are shunning the costs in favour of renting in city environments to save money in the short term. House prices can be astronomical in and around city centres, so many choose to rent close by and enjoy all the easily accessible amenities without being tied down to a mortgage, which can take 25 – 35 years to pay back.

Better Social Life

Renting allows co-living and house sharing, meaning that the rent costs can be cut down considerably for each person, and their social life can thrive too. As people can also rent closer to the city centres more cheaply than buying, they save money on travelling plus have more opportunities to go out and meet friends.

The 5% Deposit Scheme

Introduced in April 2021 and expected to end in December 2022, this government scheme aims to increase the number of deals available to first-time homebuyers. However, despite the advertised advantages, there are concerns that this scheme will only benefit the mortgage lenders instead of the house buyers. This is because it covers most of the costs should the lender lose money yet operates as a standard mortgage for the buyer. Coupled with the fact that experts believe this scheme will raise house prices in the long run, many people are continually avoiding taking part and choosing to rent instead.

The Increase Of Rent Prices

Despite all the advantages that come with renting a property, the increased demand for renting has resulted in a steady rise in rent prices. Alongside this, the government has temporarily reduced the Stamp Duty Land Tax. Although this doesn’t directly affect all renters, the fees are expected to rocket once the reduction is over, further raising the rent prices for some properties.

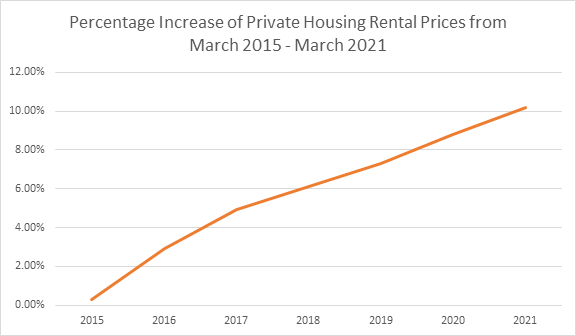

As the number of new potential renters continues to rise, the number of properties managed decreases. Hence, landlords increase the rent of current tenants to make up for the losses. This is the main cause of the steady incline of rental prices demonstrated in the graph below.

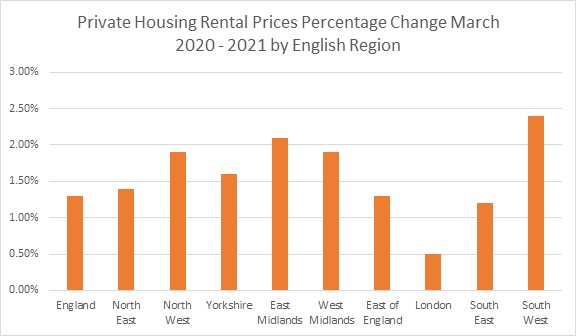

By region, rental prices have seen the most significant increase in the South West. Surprisingly, London and the South East have seen the smallest gains, though this is suspected to be because more people are likely to buy a house in these areas.

Buying vs Renting

Both buying and renting a property come with their benefits. The ultimate decision, though, is down to the person and their way of life. For example, if someone doesn’t like to stay put for long, renting is best suited to their lifestyle. However, buying will provide more security for someone looking to settle down and maybe extend their family. Here are some advantages and disadvantages of both options to help educate you and potentially decide which would be best for you.

Buying

Purchasing a property can be a safe, long-term investment that grows over time and helps you set up a permanent home for you and your family, no matter how big. Some advantages of buying a house include:

- You can’t be forced to move out by a landlord

- The money you pay out each month goes towards eventually owning your home rather than directly to a landlord’s bank account

- You completely own your home once your mortgage is paid off

- You stand to make a profit should house prices rise and you want to sell

- Any changes or improvements you make to your house are likely to increase the selling value

- You don’t need permission for pets, redecoration, or any changes you wish to make

On the other hand, buying can bring a few problems, especially if you are unprepared. You’ll need to have enough money to cover upfront costs such as stamp duty tax and mortgage fees for up to 6 months, plus a squeaky-clean credit rating and some long term commitments to make. Here are a few of the disadvantages to owning your own home:

- The rise of interest rates can increase your monthly payments (though a fixed-rate mortgage should help you budget if available)

- You have to pay for any repairs and organise for someone to come and fix them, including urgent issues such as leaks

- Falling behind on payments will lead to strong financial consequences

- Should you wish to move out, you will have to wait until your current home is sold first

- Moving to a cheaper property will also take a fair bit of time if your finances fall

- If you apply for a joint mortgage with a partner and later separate, selling the property can become complicated

Renting

Renting a house is perfect for someone who will be required to move around a lot due to work or someone who wants more freedom in their future. The advantages when renting a property include:

- The process of finding and renting a house is usually quicker than buying one

- It is often cheaper monthly, and the payments are highly unlikely to change, so budgeting is easier

- The landlord will pay for repairs and required renovations

- You won’t lose any money if the property’s price drops

- You’ll likely be able to rent a larger home in a better area than you could afford to buy

Despite this, there are a few downsides to renting. Since you don’t own your own house, some of the benefits of being a house owner become detriments to a renter. A few of the disadvantages to renting your home are:

- If your landlord wants to sell or bring in new tenants, you have to move out

- Your landlord could decide to increase the rent

- Your landlord can set rules and limit the changes you can make

- You have to pay a deposit, most of which the landlord will likely get to keep

- Any improvements made to the property will increase its price, but this will only benefit the landlord. However, there are a few ways to make your rental property feel like home whilst only benefiting you.

- If you never plan on buying a house, you have to pay rent for the rest of your life, even when you’re retired

Will The U.K Become A Nation of Renters?

With renting on a constant uprise, it is expected that more people are likely to rent than own a home in the future. That being said, nothing is set in stone – rent prices could increase more than house prices, or interest rates could make owning your own house damn near impossible – so, for now, the only thing we can do with certainty is see what the future holds.

Got your own thoughts on renting? Let us know in the comments below.

Sources

[1] https://www.ons.gov.uk/economy/inflationandpriceindices/articles/ukprivaterentedsector/2018

[1] https://www.struttandparker.com/knowledge-and-research/the-rise-of-the-renters [1] https://www.bbc.co.uk/news/business-57260261